Homes for Auction in AZ

“just how do foreclosures work?”

“just how do foreclosures work?”

“If I stop making residence repayments, just how long until the lender forecloses back at my home?”

“I’m considering purchasing foreclosures at auction. Understanding that process?”

Those questions ”“ and some horribly misguided / flat-out wrong responses ”“ appear usually in both on and off-line conversations.

Before we diving into the property foreclosure procedure in Arizona, allow me to make a very important factor perfectly obvious:

I'm not a lawyer, nor do We play one on television and/or interwebs. If you're facing property foreclosure you would be well advised to get the advice of an attorney, in addition to a tax expert. In addition, foreclosure laws, processes and timelines differ by condition. Here are some right here applies to ARIZONA. It might probably or might not be precise for your state.

Here’s the information (fundamentally) as to how foreclosures work in Arizona. . .

Without getting too esoteric, it is crucial that you realize Arizona runs as what is known as a title theory condition ”“ property name continues to be in trust until your loan is paid down. Legal name is held by the lender, as well as the borrower/home owner has equitable title (the ability to control and employ associated with the home within the lack of standard). In a lien concept state subject is held by the debtor additionally the loan provider places a lien resistant to the residential property to secure the debt.

Exactly why is this crucial? Because how subject is held determines the foreclosure procedure (that, and condition law).

In a title theory condition, the foreclosure procedure is governed by the energy of purchase term in your load documents. The effectiveness of purchase clause provides the lender the ability to offer the property in the event that you default (don’t result in the repayments). That is also called a “non-judicial foreclosure”, which means the complete property foreclosure procedure can happen with no judge participation or expert. Most foreclosures in Arizona are non-judicial in nature. Because you can have guessed, a lien concept condition requires a judicial foreclosure ”“ the courts really need to get included. This definitely makes the process slower and more expensive.

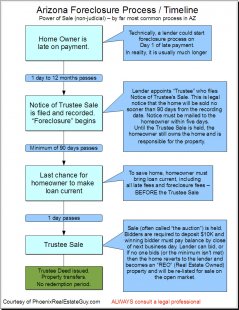

Therefore let’s have a look at the measures involved in a non-judicial foreclosure:

1) The home owner goes in default. Theoretically speaking, a lender could start the property foreclosure process on Day 1 that the mortgage payment is regarded as late. Actually, that does not happen. Typically it requires almost a year of missed payments ahead of the loan provider initiates property foreclosure. The reason why? because they desire your cash, perhaps not your house. So whilst harassing telephone calls may turn early, it is very unlikely that a lender will begin the property foreclosure process on the first missed payment. I'm sure people that have missed repayments for a complete 12 months ahead of the process gets spooled up. The full time may differ wildly by lender, plus similar loan provider goodies consumers differently.

2) The Notice of Trustee purchase is submitted. At some point, the financial institution will opt to initiate the property foreclosure process and they (more accurately, the Trustee) will capture a Notice of Trustee Sale (NOS). Some loan providers may issue a Notice of Default (or need) (NOD) just before a Notice of Trustee Sale as a kind of “final caution” that your house is approximately to go into the foreclosure process, but NOD’s aren't required under condition legislation.

There are lots of principles that stipulate the way the NOS is handled. It must be taped within county recorder’s office. It should be advertised once a week for four consecutive months in a nearby newsprint (the very last “advertisement” needs to be published not less than 10 days prior to the date associated with purchase). The notice should be published, either at a conspicuous place on the home, on courthouse, and/or trustee’s place of business. Finally, within five times of the recording associated with Notice of Trustee Sale, a copy needs to be mailed via certified mail on property address (the mailing and/or posting from the property is actually when tenants learn the home they've been renting goes into foreclosure).

The Notice of Trustee purchase will specify in which and when the property is to be sold “at auction”. Occasionally the purchase takes place “on the courthouse actions”, and often it really is within trustee’s company. By law, the sale has to take location at least 3 months following the notice is recorded. (Of note, trustee sales are often postponed, however they can't occur significantly less than 3 months following the NOS is recorded.

Redemption Stage. Poke around on the internet and you will see mention of “redemption durations” ”“ an occasion period in which a house owner can catch up to their loan to get their house straight back. In a few states this will happen despite the home is sold at foreclosure. (Alabama has actually a 12 month redemption period.) In a non-judicial property foreclosure (once more, here is the great majority of foreclosures in Arizona) there isn't any redemption duration. Property owner makes their loan present anytime before the real purchase preventing the process. But when the gavel drops on trustee sale, the deal is completed plus the property owner doesn't have additional possibility to retain their property.

Share this Post

Related posts

How to become a REALTORS in AZ?

Tammy, Today..I m going to give you the real answer! (LOL) i m over 40 and have now already been accredited Realtor for…

Read MoreHouse Auctions in AZ

(5143 results) Discover foreclosed house auctions for real estate in Scottsdale, Maricopa County, AZ. Include Trustee Sales…

Read More